The Historical Rate of Return for the Stock Market Since 1900

July 30, 2014

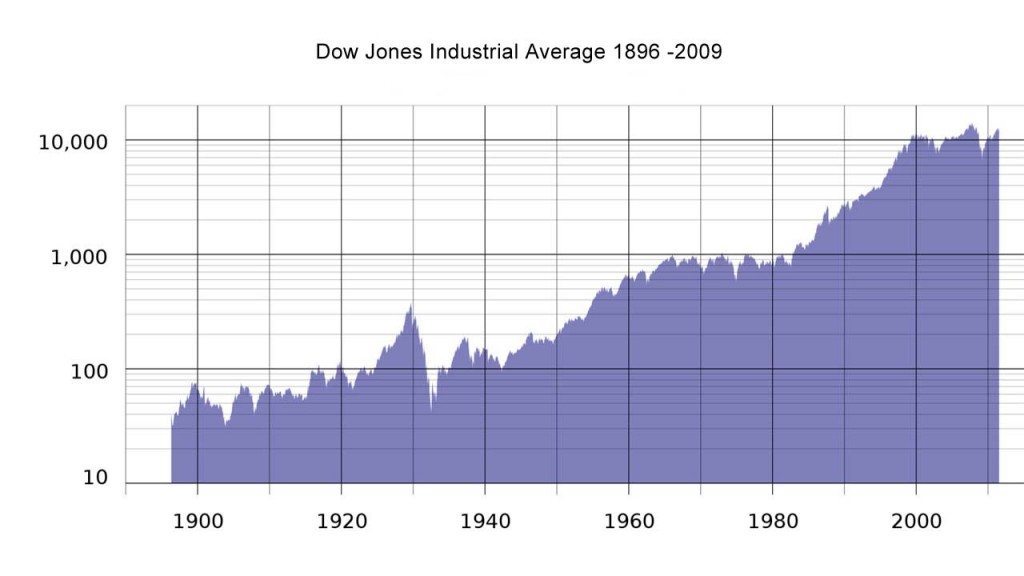

The Historical Rate of Return for the major indexes is an important part of stock market history. The rate of historical returns needs to include dividend distributions in order to get an accurate measure of the total return one would have gotten from investing in the stock market.

During the 20th century, the stock market returned an average of 10.4% a year. Just $1,000 invested in 1900 would be worth over $19.8 million by the end of 1999. At 15% average return per year, it only takes 30 years to turn $15,000 to $1 million.

Stock Market History of Returns

| Decade | Average Return Per year |

| 1900s | 9.96% |

| 1910s | 4.20% |

| 1920s | 14.95% |

| 1930s | -0.63% |

| 1940s | 8.72% |

| 1950s | 19.28% |

| 1960s | 7.78% |

| 1970s | 5.82% |

| 1980s | 17.57% |

| 1990s | 18.17% |

| 2000s | 1.07% |

| 2010-2013 | 16.74% |

How the Historical Rate of Return of the Stock Market is Calculated

Over the stock market history, corporate earnings have gone up an average of 7% per year and the inflation history of the markets shows that inflation has averaged around 4% per year.

The % weights of sectors have changed a lot from 1900 to 2000. For example, back in 1900, railroads made up over 60% of the stock market yet makeup only .2% today. More than 60% of American’s lived in rural areas in 1900 and by 1990 that number had dropped to less than 25% according to the U.S. census.

What we have done is compiled data that shows the price change and dividend distribution to come up with the total market return.

For other uses, see how the historical rate of return varies greatly based on stock market historical events

OMG! This is really big amount. I wish I would have invested 1000$ in 1900 and would get $19.8 million by the end of 1999.

oh these conversion rates are very good. I hope there rate come again this 2012 lol

Oh! Avg. returning rate in 1990s is quite impressive

The small print down the page a bit… 7% average – minus 4% inflation – how is that impressive? Adding in Dividends etc is nonsense… basically drinking your own cool aide. The real rate of return is 3 to 3.5%

Brian is absolutely correct. The rest is fiction!

dont forget that inflation reached 13% in 1980 biasing the average returns

Once upon a time you could buy virtually any mutual fund and expect a fifty percent, and better annual return! Think Clinton era.

UNTIL THE BUBBLE BURST AND MANY SMALL INVESTORS LOSTMORE THAN HALF THE VALUE: THINK CLINTON ERA.

There is an important investing lesson involved here. Investing is more about patience and discipline than timing.

could someone be so kind that help me how to calculate market rate of return?

If I had 250,000 cash in 2004. What would be the best strategy for highest return? invest in stock market or real estate?

Bitcoin was $0.01 in May of 2010 so $250k would have gotten you 25 million bitcoin. Now at $15k each that would be worth $375 BILLION DOLLARS!!

Because of leverage the real estate market would have been better. Especially in hots markets like the SF Bay Area. I didn’t do this but wish I had. The real estate market is less volatile. Might go flat or dip a little. But it doesn’t tank 50% as stocks did in 2000 and 2008.

There is a cyclic pattern observed having analysed the whole data over a century. A decade of growth and above normal returns is followed by a decade of recession and average or below average payback. Looks like 2010-2020 will also deliver superior returns…

I don’t understand how to make money from the stock market.

TALK WITH AN INVESTMENT PROFESSIONAL. HE CAN ADVISE YOU ON OPENING AN ACCOUNT THAT MATCHES YOUR GOALS. I WOULD SUGGEST AN INDEX FUND FOR THOSE WITH LIMITED KNOWLEDGE OF THE MARKET. INVESTING IN INDIVIDUAL STOCKS IS A MIGHTY RISKY BUISNESS. THERE ARE SOME GOOD MUTUAL FUNDS BUT YOU REALLY NEED PROFESSIONAL HELP HERE, AND TAPE RECORD EVERYTHING THE SALESPERSON TELLS YOU.

I love this businees

The return rate in 1990s is not bad

There is no better way to invest over a long term than the stock market. I suggest no-load Vanguard index funds due to their solid performance and very low fees. They have several to choose from. You will probably need a thousand dollars to get started with them. Charles Schwab has no-load low fee index funds that you can open with as little as fifty (SWPPX), to one-hundred dollars. Then you need the confident approach of a turtle: easy, persistent, confident, rolling with the volatility and not panicking while gradually building wealth a basket at a time over a long haul, and out performing the rabbit minded investor. Remember: keep a steady, modest cutting expectation over a long haul.

No, timing is everything actually Beffett’s money was made in 1970s He got out of the Market completely in 1968 and closed his partnership because of high valuations not supported by anything – same thing in 2000, 2007,. Patience means nothing if you are 70 and not working. Sure, when you are young dollar cost works well, but we are not all the same age and cycle. Someday cash is king. COT.COM crash was like the Gold crash of 1976 everyone wanted in – that’s when to fear, when everyone wants out that’s when to buy. Schiller is right.

Do not just buy and sell, wait for th be wave since you can sell then.